Property is a great wealth building tool – where used strategically. Property is not about tax. Paying tax is actually a good thing. It means you made money! So why is there so much focus on purchasing property to enable tax savings?

In this blog we look at cash flows associated with a brand new Off the Plan (OTP) property and an established property. This is based on our first-hand experience in the investing career.

Facts

- Brand New / OTP purchases cost anywhere around 10% (or more) more than the established property up the road

- Buying OTP and paying more for it to obtain tax depreciation benefits means you pay more to get 30 cents back (or 40 cents back – depending on your income tax bracket)

- Nobody has a crystal ball as to where the market will be in the next year, 5 years, or 10 years, However, what we do know is property markets are cyclical, which can be used to your advantage

How do the numbers ACTUALLY look?

Tax is a big one when people consider buying property. Often the focus tends to be on tax savings and not what they want the investment to do for them over the long term. We have heard more than once that ‘our accountant told us to negative gear, as we were paying too much tax’. This may be well meaning advice; however, tax is only one of the many other factors which should drive your property investment decisions, with the ‘goal’ associated with the investment being the paramount driver in your decision on whether a particular deal will make a great investment for you. There is no one strategy that fits all, so you need to start with your end goal in mind.

Whilst there are tax benefits on the interest repayments, let’s JUST look at the DEPRECIATION benefits that the majority focus on.

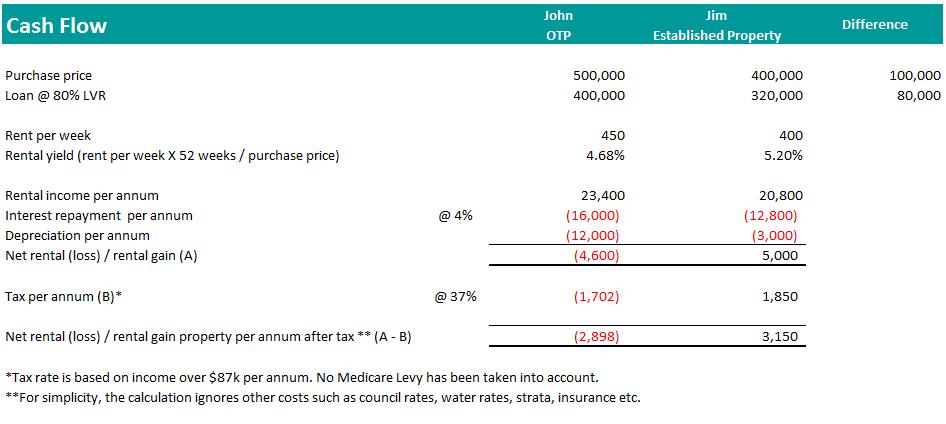

Let’s say John and Jim are individuals who both earn $100,000 EACH per annum. They are both in the 37% Tax Bracket. They both buy a property each in a flat market poised to grow, given the fundamentals in the city they are buying in, as well as the rental returns that the market currently provides due to the placement of the property cycle.

John buys a $500k OTP unit which gives him $12,000 depreciation per annum.

Jim buys an established 10-year-old unit up the road from John’s for $400k which gives him $3000 in depreciation per annum.

John’s OTP Purchase: $500,000

At 80% Loan to Value Ratio (LVR), the lending for the property is $400k

The BOTTOM LINE IS @ 4% interest rate, the repayments on $400k are $16,000 per annum and depreciation of $12,000 (Total loss of $28,000)

With the rent being $23,400 per annum, net cash loss before tax = ($4,600)

@ 37% of the Net Cashflow position of ($4,600), the tax man will return John, $1,702 resulting in an after-tax cash loss of ($2,898)

Jim’s Established Purchase: $400,000

At 80% Loan to Value Ratio (LVR), the lending for the property is $320k

The BOTTOM LINE IS @ 4% interest rate, the repayments on $320k are $12,800 per annum and depreciation of $3,000 (Total loss of $15,800)

With the rent being $20,800 per annum, net cash profit before tax = $5,000

@ 37% of the Net Cashflow position of $5,000, Jim will pay $1,850 resulting in an after-tax cash profit of $3,150

What’s the capital growth?

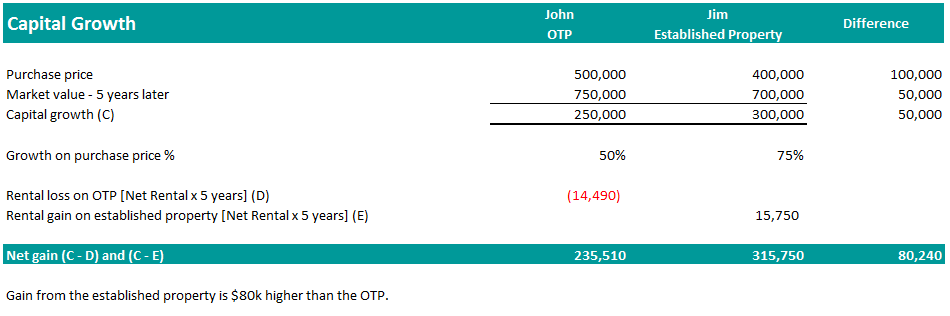

Hypothetically, in 5 years’ units similar to what John and Jim bought are selling for $750,000 (for 5 years old) and 700,000 for 15 years old, respectively.

John’s $500k unit has grown to $750,000 – 50% capital growth in 5 years ($250k gain on $500k purchase price)

Jim’s $400k unit has grown to $700,000 – 75% capital growth in 5 years ($300k gain on $400k purchase price)

The net gain after the NEGATIVELY geared property for John is $235,510 and for Jim, although Jim had to pay tax on the rental income, positive cash flow means, Jim’s net gain is $315,750

OUTCOME: Whilst you are paying tax on the established property per annum. The bottom line is, given your low starting base you make better financial gains with an established property purchase .

When the boom happens, all properties grow in value whether OTP or established. It depends on at what stage the property cycle is at. If it is a rising market, and you buy OTP, the growth of it can be linked to ‘timing’. In a steady market, however, it will be naive to expect that OTP which has already been purchased with premium prices will give you the equity in the near future to enable wealth building through property.

THE TRUTH

- There is no guarantee you’d be working for the same employer in 10 years (uncertain times, changing life priorities, change in demands to name a few). So why bank on a crystal ball of definite gains in property through tax savings?

- To make a decent tax advantage in investing, you need to lose money

- Making a loss is rarely a good business strategy

- Tax rules can change any time. Use this as a BONUS, but not a driver for your wealth creation decisions

Given there is no crystal ball, we don’t know how the markets will behave in the future. There are economies within economies and each individual has their own economy and reality to make things work. In fact, there is no one right answer. The cat can be skinned in many ways. As long as you know where you are headed, take calculated risks and the properties you buy don’t impact your lifestyle or put mental pressure on you, there is no reason why you cannot build a successful real estate portfolio.

Either way, there is one guaranteed outcome for sure – doing nothing is not safe and taking action to lose money is worse. Remember, taking prudent action towards a better financial future is better than no action at all.

To Get Started: Schedule A Chat with the Property Twins Team Join Our Exclusive Facebook Community of 6,000+ Property Investors: Property Addicts Australia Join our Exclusive Search & Select The Right Property in 90 Days 5-Day challenge

Note: Please ensure you always seek specific specific credit, tax, financial, legal or investment advice. Property Twins' Blogs are not a substitute for personal and specific, taxation, financial, legal or investment advice

Question:-

Isn’t established property have higher entry point into the investment scene, i.e stump duty, renovations etc? They also require you to purchase at a market value? While with a new property you pay stump duty on the value of the land only, the building cost is the builder’s cost of material, labour plus a bit of margin and also you get a higher depreciation as well. I guess, what I am trying to understand is that if you don’t have much cash to spend but want to get started in investing, wouldn’t brand new/OTP be the best option?

Hi John

A couple of things to consider – building on your own is different to buying an off the plan apartment or a house & land package. Unless you are buying a house & land package in an infill area there is little use in purchasing where there is pelothra of land OR for that matter an over supply of units.

Brand new properties often command a premium – whether you are building yourself or buying new. Established property is in fact cheaper to acquire. Suggest looking up an area offering both established and new properties and comparing the prices.

Stamp duty concessions: Stamp duty is a much smaller cost compared to the premium priced new properties. Whilst you may save 10k-20k on stamp duty, you are already paying much more for the property itself as a packaged price.

Sure you can make money with these – however pick your areas – as long as there is little abundance of land or similar properties i.e. unqiue factor, coupled with fundamentals – go for it.

Depreciation helps the property holding costs, however tax is only one factor to consider. We see tax as the icing on the cake. Personally our goal has been to buy well established located properties which offer depreciation such that your holding costs are neutral to positive. If establish property can offer you that, what’s the benefit in over paying for a new and shiny product to help with tax benefits? Capital growth is going to be much smaller accordingly given that you have over paid.

Again, if you don’t have much cash to spend, the first home owners grant and the concessions on new properties may help you get in the market. But make sure you take into account the opportunity cost given you will already start on the back foot by over paying much more than the established properties. This will certainly impact your ability to extract equity and purchase the next one. Also with established stock, as you call out you can value add to increase equity and therefore move on to the next one!

When buying OTP or H&L package, it may pay off if bought in a rising market. Depends where you are buying is on the property clock. Though the growth will not parallel if bought in a flat market if you compare with an established property.

Hope this answers your question.

Brand new houses can have some benefits of their own.

I built late last year at Caloundra and worked with an agent to find the best lot in the estate, and to design a floor plan and pick inclusions which are altogether tailor-made for maximum rental yield.

Building gives you a blank canvas.

I have a couple of older houses too and it seems like every couple of weeks I am spending money on repairs as things deteriorate, yet my new house is fully covered with a builders warranty.

These are some benifits of building in my experience but to me, the bottom line is to diversify your portfolio.

Where one property is losing, another will be winning.

Great to hear it’s worked well for you Dave. Mind you it’s OTP shiney properties in estates and apartments that are a major issues. The commissions offered on these are huge – and can be up to 10-12% of the purchase price. You took action and did your research. Unfortunately, not everybody is educated enough (just yet) to do that. This is costly and can put people back 10+ years in their investing journey. Thanks for your comments.

Cheers

Property Twins

Hi Twins,

In regards to the after tax figure for John and Jim, I am getting a different figure to yours. I am no accountant or expert by any means, but if you could please shed some light.

By my calculation with the figures you have provided, I am getting John’s OTP $9102 per annum positive after tax and Jim’s $6150 per annum positive after tax.

Look forward to your response.

Kind regards,

Hasan

Hi Hasan,

These figures are ballpark to show you the concept. This isn’t tax advice. Do suggest you speaking with your tax accountant for accurate figures.

Cheers!