PRO TIP 🔥

Looking to set up your home and investment loans correctly, so you maximise tax savings and minimise risk?

Start with ensuring your loans are not cross collateralised…

It may have it’s time and place, however several CONS to the approach…

> Banks encourage you to cross collateralise. It enables them and disables you from either moving lenders or selling the property. It effectively keeps the business with the same lender.

For simplicity, the bank holds power on any equity releases or sale profits (before you get to benefit!).

> Should you WANT to access the equity, you are at the mercy of the valuers valuing all your properties adequately, subsequently requiring full applications and assessments of each of the properties (unless of course you can get sufficient valuations and do a partial discharge of the security / securities involved). This is costly and time consuming

> Consider what if borrowing calculators OR your life circumstances change later on and you being unable to go back to restructure because you can no longer service the loans as they currently stand

We had a client specifically come to us to uncross their properties because one of their friends who sold one of their properties, never saw the profits as the bank valued the EXISTING security and only gave them access to the balance of the profit (if any!)

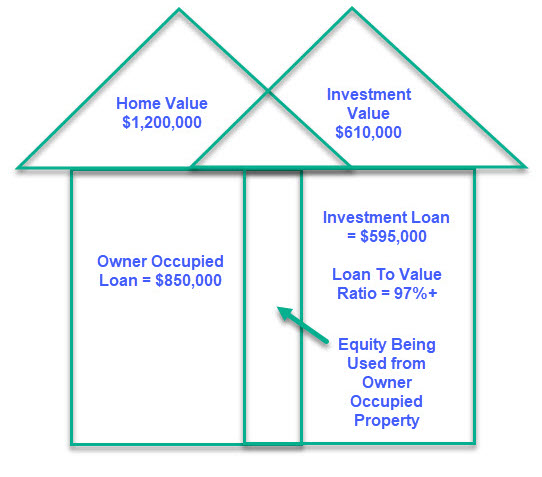

This image shows how cross collateralisation MAY look like. Where the loan to value ratio on one of the securities appears unreasonably high (AND you haven’t paid LMI).

Don’t be fooled though as the values may have increased significantly, it’s still worth un-crossing especially if you are considering selling or tapping into equity from one of the securities as the lender WILL value both properties whenever you want to do anything with the loan.

It can be two or MORE properties that are cross collateralised. Recently we uncrossed 3 x securities.

How do you know your properties cross collateralised? Refer to your loan contracts you signed – this will have all securities listed together in one contract.

Note, when you un-cross, it will come down to:

- Valuation of the properties involved

- Maintaining the tax effectiveness of the loans involved

- Keeping the loans independent of each security (allocating the right equity to the right place)

- Also consider your future goals as you may be considering investing further – so tap into the equity while you’re cleaning up the structures

Doing your loans correctly will save you a whole lot of money and future stress

Hope this helps 🙏

To Get Started: Schedule A Chat with the Property Twins Team Join Our Exclusive Facebook Community of 6,000+ Property Investors: Property Addicts Australia Join our Exclusive Search & Select The Right Property in 90 Days 5-Day challenge

Note: Please ensure you always seek specific specific credit, tax, financial, legal or investment advice. Property Twins' Blogs are not a substitute for personal and specific, taxation, financial, legal or investment advice